|

Seed Prices Have Soared-Is intellectual Property the Problem?

How Intellectual Property, Regulation, and Research Can Make Agriculture More Competitive

sourced from The Breakthrough Institute

Agricultural seed prices have soared over the last 20 years. Conventional seed prices have risen 200%, while genetically modified ones have gone up a dramatically higher 700%.

This is a problem for farmers, consumers, and the government. High seed prices contribute to tight margins for farmers, and can contribute to high food prices, which consumers must bear. These problems aren’t theoretical. Last year, high fertilizer prices were contributing to such a steep rise in food prices that the federal government took action in May to try to tamp them down.

High seed prices may likewise demand action. Already, over the summer, the USDA released a request for comment on the impact of intellectual property rights on prices for seeds and other agricultural inputs like herbicides. It says it will use the comments to inform strategies to ensure that the intellectual property system incentivizes innovation without unnecessarily reducing competition in agricultural input markets. In May, the Breakthrough Institute submitted a comment, which can be accessed here.

Many proposals to reduce prices focus on halting further industry consolidation; for instance, stopping mergers and more closely regulating company practices. Indeed, the agricultural seed industry has seen dramatic consolidation over the past three decades, leading to the “big six” companies, which with mergers and acquisitions completed in 2017 and 2018, became the “big four” (Bayer-Monsanto, DowDuPont/Corteva, ChemChina-Syngenta, and BASF); however, the evidence for the impact on competition and prices is mixed. A wider set of associated systems, including intellectual property, regulation, and research, can also stimulate competition and innovation. And although intellectual property does have an impact on prices for genetically modified seeds, these two other factors also play hugely important roles — regulation and public research funding. For genetically modified seeds, IP, regulation, and funding have an even greater impact on prices, contributing to the larger historical price increases compared to those for conventional seeds.

Improvements to all three of these systems can help provide quality seeds for farmers at reasonable prices, and thereby help produce more and better food with lower environmental impacts.

So how do IP protections increase seed prices?

Since the 1980s, scientists have been able to use genetic modification—a type of biotechnology— to insert a gene into a plant from either a plant of the same species, a plant of a closely related species, or a more distantly related organism of a different species. Gene editing—or genome editing, a process for which CRISPR is the most well-known tool—is another type of biotechnology that allows scientists to make precise changes to a plant’s existing DNA, either by changing or deleting one or more letters of the DNA code. In contrast, conventional breeding involves crossing plants, mainly of the same or closely-related species, and using chemicals or radiation to create random mutations.

For genetically modified seeds, both the genetically modified traits they contain and the methods used to make them are usually patented, and patent protection allows developers to charge licensing fees for anyone who uses either the methods or the genetic material. In contrast, conventional seed varieties usually fall under Plant Variety Protection, which protects the seeds (or vegetative material) but not the genetic material, meaning that other developers can freely improve upon it to make similar and often competing varieties. These differences mean that genetically modified seeds come with higher licensing fees from the start.

To be sure, those protections and fees have their benefits; the U.S. intellectual property system was designed to encourage innovation by granting inventors a patent for their inventions. In agriculture, the benefit of this system can provide stronger protection for the massive investment that goes into developing a new crop variety.

But the costs it adds are non-trivial. For genetically modified crop seeds, added expenses can come through various mechanisms. First, if intellectual property for an important tool for genetic modification or gene editing is held by a single organization, they can either license it widely for a low price, or impose high prices and license the tool to only few other organizations in order to monopolize the technology. The latter could result in higher prices due to reduced competition and lock some developers out of using important technologies.

Second, licensing agreements and prices usually aren’t publicly available, which makes it hard for developers to find out how much licenses cost, negotiate a price, or compare prices among patent holders.

Third, with hundreds of different patents on CRISPR components already in existence—and more filed every day—it can be difficult for new developers to determine from how many and from which patent holders they must license technology, and licensing from multiple patent holders can be expensive. All three mechanisms can create barriers to entry for smaller developers and new developers, and reduce competition in the industry, potentially increasing prices. To help ease the burden, the federal government, mainly the USDA, can take several approaches to mediate the role of the intellectual property system in raising crop seed prices while also protecting the incentives to innovate.

In order to support broad technology access and innovation, USDA and other agencies could launch an initiative to define fair licensing practices, using input from stakeholders to define and operationalize technology access and access to intellectual property.

USDA and other agencies could also create funding initiatives for projects that develop technology-sharing systems like the existing Open Science Initiative at the Montreal Neurological Institute, the BioBricks OpenMTA, and the World Health Organization’s Global Influenza Surveillance and Response System. Finally, USDA could expand access to affordable seeds by encouraging companies to develop generic versions of genetically modified seeds when the patents on their traits expire, similar to the FDA’s support for generic versions of drugs via the Drug Competition Action Plan.

While the recent USDA request for comment on intellectual property is on the right track, the IP system is not the only factor in discouraging innovation or preventing public access to new and improved crop varieties at a reasonable cost. Rather, an extensive regulatory process and insufficient public research funding can also contribute to high prices.

What role does regulation play?

Genetically modified crops undergo much more extensive regulation than conventionally-bred seed varieties. And the length, cost, and reliability of the regulatory process for genetically modified crops can create a massive barrier to commercialization. The process thereby decreases the number of companies and crops entering the market.

For biotech crops submitted to the USDA regulatory system between 2008 and 2012, the entire process took an average of $136 million and 20 years, with $35 million and 7 years devoted solely to meeting regulatory requirements. In 2020, the regulatory system was revised to reduce the regulatory burden for some types of gene-edited plants — those that could theoretically have been produced using conventional breeding (this does not include genetically modified plants that contain genes from different species) — and to streamline the regulatory process for genetically modified plants. The extent to which the new system achieves these goals remains to be seen.

Although the new regulatory regime went into full effect in early 2021, some of the first submissions of genetically modified crops under the new rule were only provided with final decisions in the second half of 2022, having substantially overrun the promised timeframe for completion.

Five decisions have been released since the new rule went into effect, with the time to decision ranging from 332–448 days (regulations state that USDA must complete the review within 180 days of receiving a request). It remains to be seen whether subsequent rounds of submissions will receive decisions within the established timeframe as USDA gains experience with the new regulations.

Long regulatory timelines present many issues for companies, particularly for new developers without large financial reserves or existing products that provide revenue — but unreliable regulatory timeframes are equally if not more problematic because they’re difficult to plan around. USDA should ensure that decisions under the new rule follow a predictable and reasonable timetable. In addition, USDA should safely reduce the regulatory burden for as many types of genetically modified crops as possible by using existing provisions within the regulation, including the system of petitions for new exemptions.

How can public research funding help?

Government funding for agricultural research and development is also critical to driving innovation and stimulating competition. As a 2018 OECD report noted, public sector efforts to develop and release high-quality and affordable varieties can limit large firms’ power in situations where industry concentration has led to reduced competition. However, public sector crop breeding may be even more impactful in areas with little interest from large firms, like crops that are less widely grown and are therefore often associated with a smaller market and lower potential for profit.

Even when there is sufficient competition, public sector funding of fundamental research plays an important role. By putting techniques—such as gene editing methods—in the public domain, governments can ensure that no firm has a monopoly on a technique and is able to prevent others from using it.

Nevertheless, federal agricultural R&D remains underfunded. Inflation-adjusted federal funding levels for agricultural R&D are approximately the same as in 2002. In contrast, the Department of Energy’s budget for energy research, development, and deployment doubled from the early 2000s to over $8 billion in 2021.

To support innovation in the seed sector, USDA could increase R&D funding, particularly for fundamental research, but also for more applied plant breeding efforts in markets where competition is low. Although the private sector invests heavily in seed development, the massive historical increases in seed prices indicate that it alone can’t address the challenge of developing varieties that help farmers adapt to climate change while also keeping prices affordable.

Seed prices matter because when they’re high, they can contribute to narrow profit margins for farmers and high food prices for consumers. To help bring costs back down, Washington needs to address three factors: intellectual property protections, complicated regulation, and public research funding. The USDA is well-placed to take action in all three areas, and improvements will help strengthen U.S. agriculture and provide high-quality and affordable food with less environmental impacts.

Editor's Note: This article is a good primer for a discussion we'll be having at our annual meeting next month. Please check the agenda link above.

|

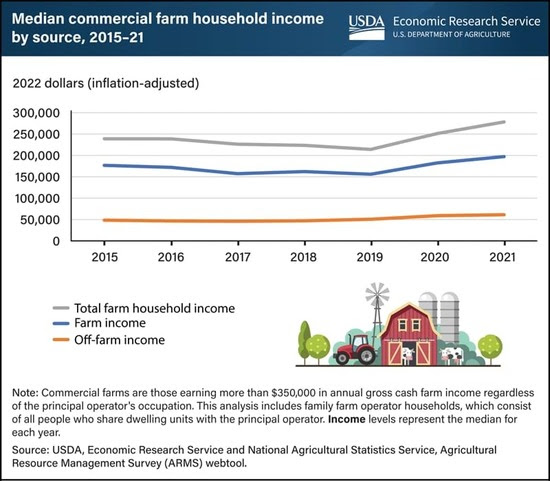

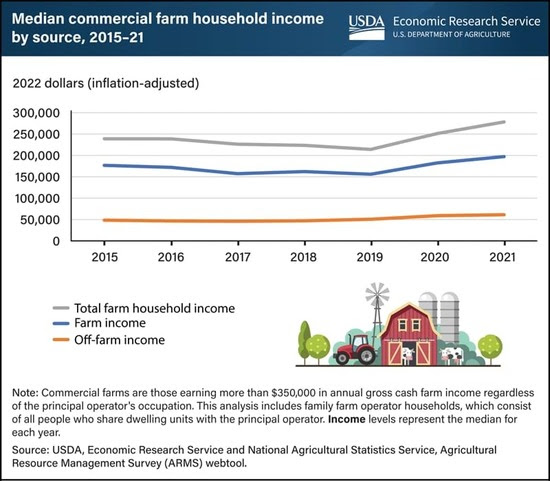

Median Commercial Farm Household Income Increases

Median Commercial Farm Household Income Increases Median Commercial Farm Household Income Increases

Median Commercial Farm Household Income Increases